Home

Financial Planning

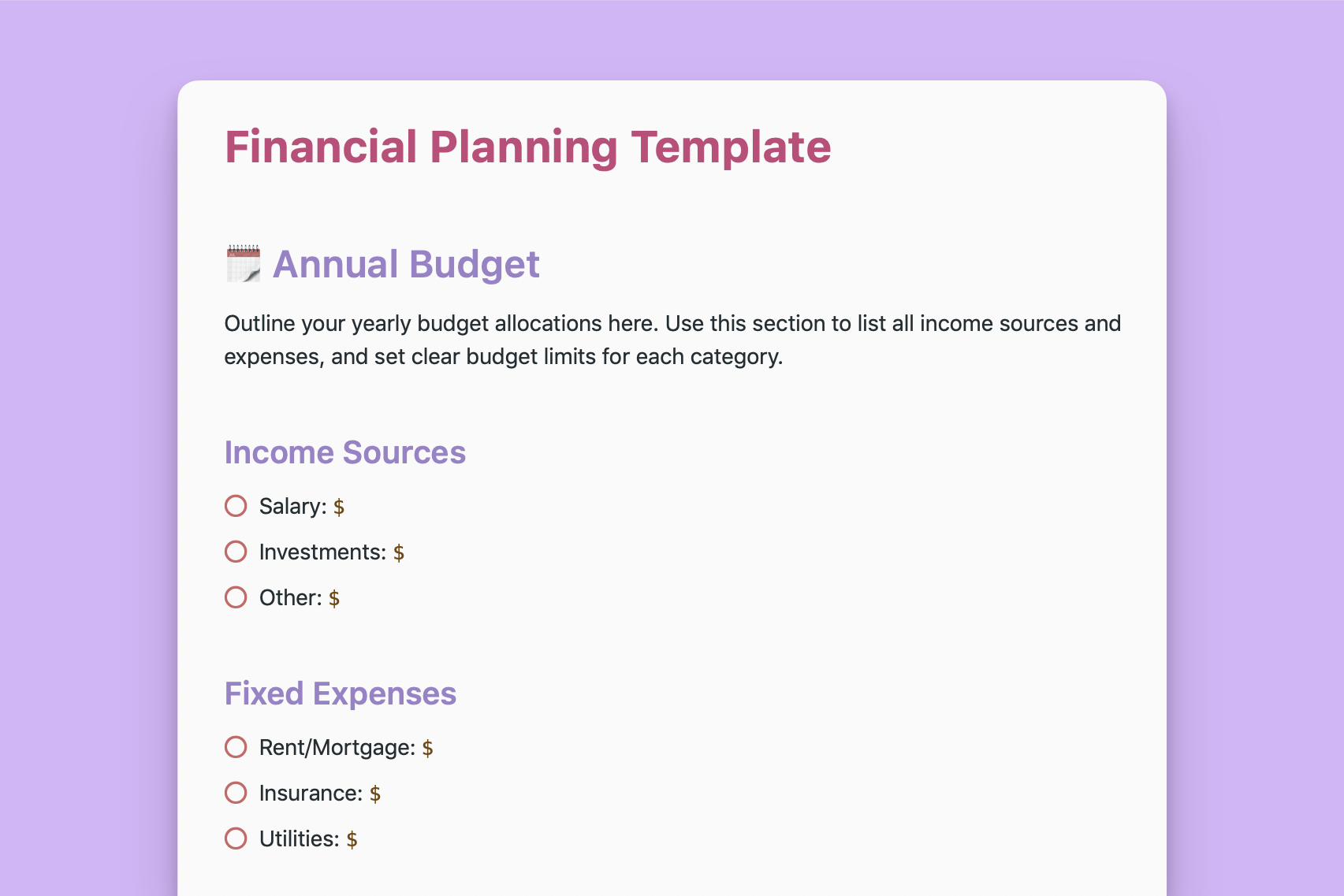

A comprehensive template to track and plan your finances, from budgeting and forecasting to cash flow and investments.

Get things done with NotePlan

Categories

Business

Work

This dynamic template empowers individuals and businesses to take control of their financial future. It provides a structured framework for managing income, expenses, investments, and more. By meticulously tracking and analyzing your financial data, you can make informed decisions, set achievable goals, and ultimately achieve financial stability and growth.

Key Features and Sections:

🗓 Annual Budget:

- Purpose: Establish a clear picture of your yearly income and expenses.

- Breakdown: Income Sources: Detail all sources of revenue (salary, investments, side hustles, etc.). Fixed Expenses: List recurring, non-negotiable costs (rent/mortgage, insurance, subscriptions). Variable Expenses: Track fluctuating costs (groceries, entertainment, travel).

- Summary Table: Visually compare budgeted amounts to actual spending, identifying areas for adjustment.

💹 Revenue Forecasting:

- Purpose: Predict future income based on historical trends and market conditions.

- Projections: Monthly: Estimate revenue for each month. Quarterly: Group monthly figures into quarterly totals. Link to Details: (Optional) Connect to a more granular forecasting sheet for in-depth analysis.

💸 Expense Tracking:

- Purpose: Monitor spending habits and ensure they align with your budget.

- Logging: Daily: Record each expense with date, category, amount, and description. Monthly Summary: Aggregate daily expenses into monthly totals. Link to Details: (Optional) Link to a separate sheet for itemized expense breakdown.

📊 Profit and Loss (P&L) Projections:

- Purpose: Assess overall profitability by calculating net profit (revenue minus expenses).

- Annual Summary Table: Display monthly revenue, expenses, and net profit, culminating in an annual total.

💰 Cash Flow Analysis:

- Purpose: Understand the timing and magnitude of cash inflows and outflows.

- Breakdown: Inflows: Document incoming cash from sales, investments, etc. Outflows: Track payments for expenses, debts, investments, etc.

- Summary Table: Show monthly inflow, outflow, and the resulting net flow.

🏗 Capital Expenditure Planning:

- Purpose: Manage investments in assets that provide long-term value (equipment, upgrades, real estate).

- Planning: List: Describe planned expenditures, amounts, and due dates.

- Summary Table: Compare planned amounts to actual spending for better budget control.

📅 Review and Adjustments:

- Purpose: Regularly evaluate your financial plan's effectiveness and make necessary modifications.

- Quarterly Reviews: Document summaries and adjustments made after each quarter.

How to Use This Template:

- Customize: Tailor section headings, categories, and details to fit your unique needs.

- Populate: Enter your financial data diligently and consistently.

- Analyze: Study tables and summaries to identify trends, opportunities, and problem areas.

- Adjust: Refine your budget, projections, and spending based on your findings.

- Collaborate: Use @mentions to share the template and seek input from colleagues or advisors.

- Iterate: Continuously update the template to reflect your evolving financial situation.