Home

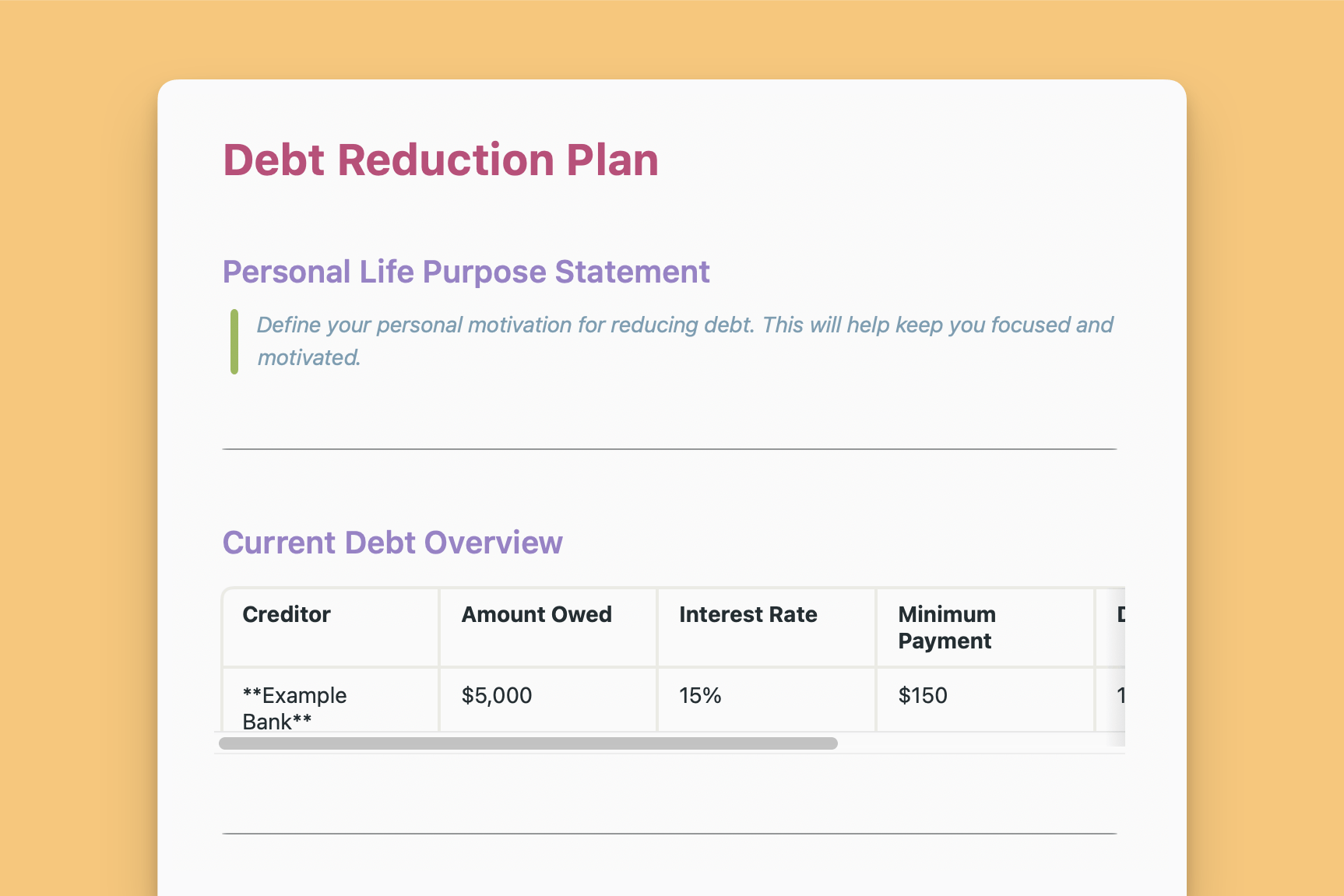

Debt Reduction Plan

A comprehensive template to create a personalized plan for tackling debt and achieving financial freedom.

Get things done with NotePlan

Categories

This template is designed to be a personalized roadmap for achieving your financial goals and gaining control over your debt. By following a structured plan, tracking your progress, and maintaining motivation, you can successfully navigate your debt reduction journey and ultimately attain financial freedom.

Key Sections:

Personal Life Purpose Statement:

Articulate your reasons for wanting to reduce debt. Is it to achieve peace of mind, save for a house, or start a business? Your purpose will serve as your anchor throughout the process.

Current Debt Overview:

Create a detailed list of all your debts, including creditor names, outstanding balances, interest rates, minimum payments, and due dates. This will give you a clear picture of your financial situation.

Monthly Income and Expenses:

Track your income sources and categorize your expenses. Understanding your cash flow is essential for budgeting and identifying areas where you can cut back.

Debt Reduction Goals:

Set SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) for both the short-term and long-term. This could involve paying off a specific debt within a certain timeframe or becoming debt-free by a specific date.

Debt Repayment Strategy:

Choose a method that suits your financial situation and personality. The snowball method (paying off the smallest debts first) can provide quick wins, while the avalanche method (tackling high-interest debts first) can save you money in the long run.

Action Plan:

Break down your debt repayment into actionable steps. This could include organizing your finances, reducing expenses, and consistently applying your chosen debt repayment strategy.

Monthly Check-In:

Regularly review your progress, celebrate milestones, and identify areas for improvement. This helps you stay on track and adapt your plan as needed.

Resources and Support:

Seek guidance from financial counselors, utilize debt reduction tools or apps, and connect with support groups. These resources can offer valuable advice, strategies, and emotional support.

Motivation and Reflection:

Create a space for inspirational quotes, personal reflections, and a record of your achievements. This section serves as a source of encouragement and helps you maintain a positive mindset.

Completion Date:

Set a target date for becoming debt-free and track your actual progress towards this goal. This serves as a tangible reminder of your commitment.

Celebrate Achievements:

Acknowledge your successes along the way. Reward yourself for reaching milestones to stay motivated and celebrate your journey towards financial freedom.

By utilizing this comprehensive Debt Reduction Plan template, you can create a personalized and actionable plan to conquer your debt, achieve financial well-being, and unlock a brighter future.