Home

Bill Payment

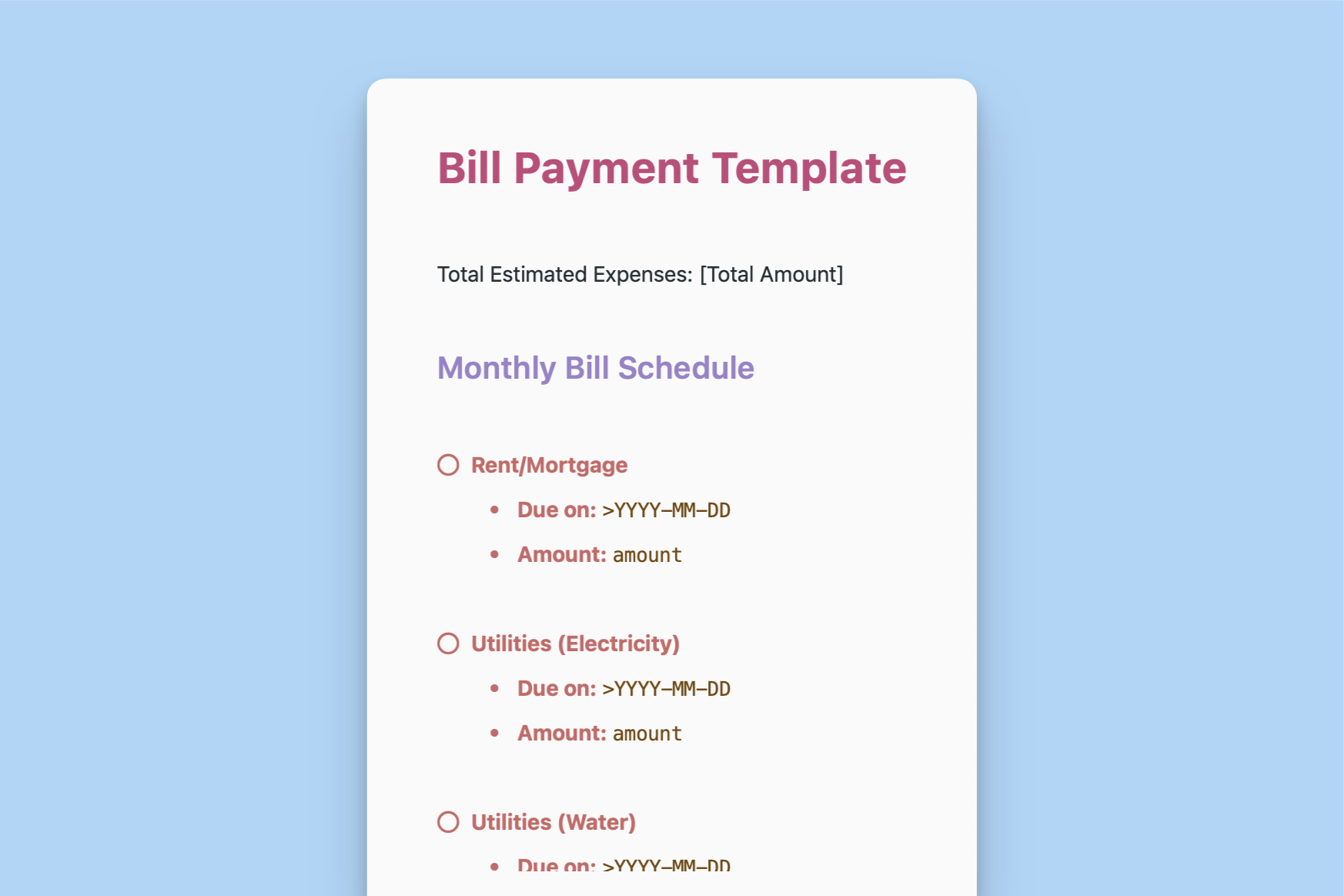

A comprehensive template to organize, track, and manage your monthly bill payments effectively.

Get things done with NotePlan

Categories

Finance

Personal

This template is designed to simplify and streamline your monthly bill payment process. It allows you to efficiently track your expenses, stay on top of due dates, and maintain a clear financial overview.

Features:

- Total Estimated Expenses: Provides a quick glance at the expected total expenditure for the month.

- Monthly Bill Schedule: An organized checklist with checkboxes to track each bill's payment status.

- Bill Details: Each bill includes fields for the due date, amount, and payment status. The template dynamically updates the total paid, remaining balance, and upcoming bills.

- Notes & Reminders: A dedicated section for jotting down important notes, reminders, and action items related to your bills.

- Monthly Summary: Provides an overview of total bills paid, remaining balance for the current month, and a preview of upcoming bills for the next month.

- Contacts for Bill Payments: Stores contact information for easy reference when making payments or addressing billing inquiries.

Additional Sections (Optional):

- Income: Track expected income sources and amounts for the month.

- Savings Goals: Define your savings objectives and monitor your progress towards them.

- Budget: Allocate funds for different spending categories to ensure financial discipline.

- Debt Repayment: Keep tabs on your outstanding debts and track your repayment progress.

Benefits:

- Improved Organization: Centralize all your bill information in one place for easy access and management.

- Timely Payments: Never miss a due date with clear visibility of upcoming bills.

- Financial Awareness: Gain insights into your spending patterns and financial health.

- Reduced Stress: Stay on top of your bills and avoid late fees or penalties.

- Customizable: Tailor the template to your specific needs by adding or removing sections.

How to Use:

- Populate the Template: Fill in the due dates, amounts, and contact information for each bill.

- Check Off Payments: Mark each bill as paid as you complete the payment process.

- Review the Summary: Regularly check the monthly summary to stay informed about your financial status.

- Utilize Notes: Use the notes section to keep track of important details or reminders related to your bills.

- Consider Additional Sections: If desired, add the optional sections to further enhance your financial tracking.

By using this comprehensive bill payment template, you can take control of your finances, reduce stress, and achieve your financial goals.